With financial pressures mounting for lots throughout the UK, greater humans are turning to secondary sources of earnings to supplement their earnings. Doing so let you reap economic balance or shop for a extensive occasion, but it is able to also be a welcome byproduct of pursuing a non-public ardour.

Whatever your motive for looking to find a secondary supply of income, right here are a number of the satisfactory approaches to go about it.

Freelancing :Secondary Source of Earnings

For those with current abilities and revel in, freelancing serves as a precious opportunity to earn greater earnings by way of supplying them paying clients. Skills which includes photograph design, content writing, programming, sales and digital marketing are all in high demand, as is the call for for bendy freelance employees.

Platforms inclusive of Fiverr and Upwork have expanded the freelance enterprise, supplying a market for customers and professionals to fulfill. With get entry to to a potentially international customer base, the opportunities are endless.

eCommerce: Secondary Source of Earnings

Selling matters on-line has in no way been easier way to marketplaces which includes Amazon, eBay and Etsy. Website-constructing platforms like Shopify also deliver human beings the tools necessary to construct their personal digital storefronts.

Whatever you need to promote, whether or not it’s home made items, antique clothes or some thing more niche, reaching customers on-line is a flexible manner to earn more money and broaden your competencies. Dropshipping is every other choice, supplying even more flexibility and minimising upfront expenses.

Investing : Secondary Source of Earnings

Generating passive income and building your wealth over time can be executed with a a success making an investment strategy. There are dangers concerned, but by way of educating your self and studying the ropes earlier than committing extra cash, you can construct a diverse portfolio incomes dividends and interest.

Choosing the right platform is essential. Some are higher for specialising in certain belongings or markets, even as others offer complete get admission to to all, such as foreign exchange trading at the forex marketplace, cryptocurrency, commodities and stocks. >>Secondary Source of Earnings

Property : Secondary Source of Earnings

Property is one of the simplest sources of passive profits and there may be ways you could earn extra together with your cutting-edge living scenario. If you’ve got a spare room at domestic or maybe a parking area, keep in mind renting it out on platforms like AirBnB or SpareRoom.

Alternatively, making an investment in a buy-to-let belongings can come up with a everyday supply of income over time. This is likewise a incredible to build your wealth, in particular if you can acquire a property portfolio. >>Secondary Source of Earnings

Part-time work : Secondary Source of Earnings

One of the most on hand methods to earn more income is to genuinely work more. Whether you could take greater hours or duty at work, or find another element-time gig that fits around your most important activity, more money is really worth it to complement your income. >>>Secondary Source of Earnings

Frequently Asked Questions (FAQs) about Income Sources: Secondary Source of Earnings

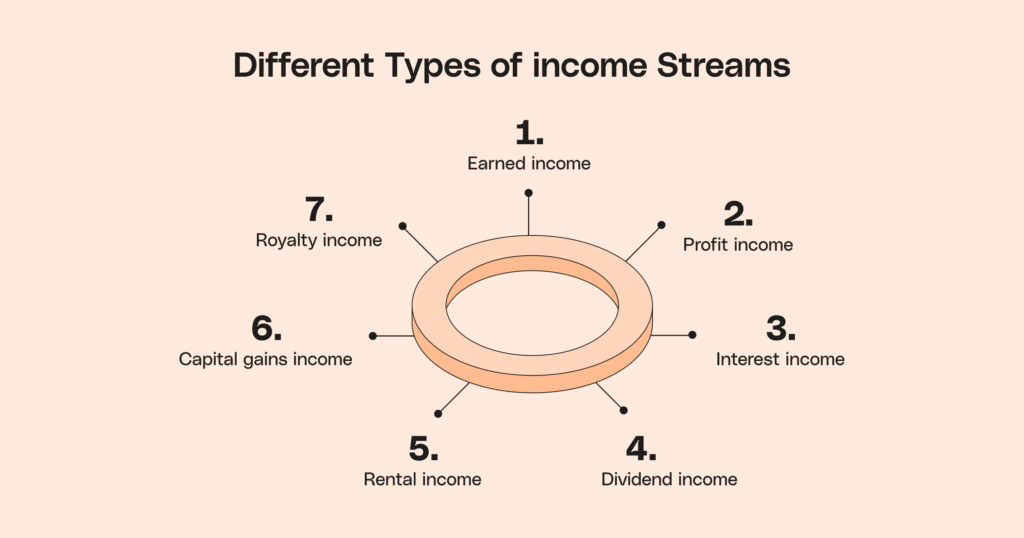

1. What are the different types of income sources?

- There are several types of income sources, including:

- Employment income: Money earned from working for an employer.

- Business income: Profits generated from running a business.

- Investment income: Returns earned from investments such as stocks, bonds, or real estate.

- Rental income: Income received from renting out property or assets.

- Royalties: Payments received for the use of intellectual property, such as patents or copyrights.

- Passive income: Income earned with minimal effort, such as dividends or interest.

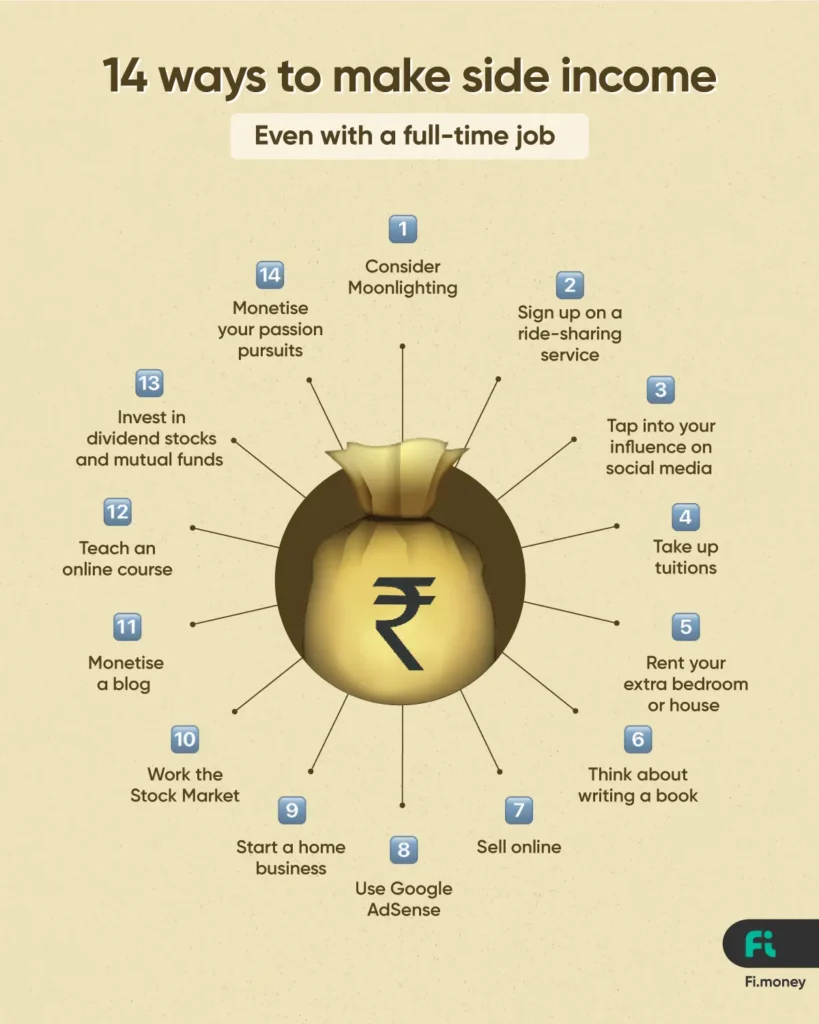

2. How can I diversify my income sources?

- Diversifying income sources involves spreading your earnings across various streams to reduce risk and increase stability. You can achieve this by:

- Investing in different asset classes, such as stocks, bonds, and real estate.

- Starting a side hustle or small business in addition to your primary job.

- Creating multiple streams of passive income, such as rental properties, dividends, or royalties.

- Developing new skills that can lead to additional sources of income, such as freelance work or consulting.

3. What are the benefits of having multiple income sources?

- Having multiple income sources provides several benefits, including:

- Increased financial stability: If one source of income decreases or disappears, you have others to rely on.

- Opportunity for growth: Diversified income streams can lead to greater earning potential and wealth accumulation.

- Flexibility: Multiple income sources can offer more flexibility in terms of work hours, location, and lifestyle choices.

- Risk mitigation: Spreading income across different sources can help reduce the impact of economic downturns or industry-specific changes.

4. How can I maximize my income from various sources?

- To maximize income from various sources, consider the following strategies:

- Continuously invest in self-improvement and skill development to increase your earning potential.

- Regularly review and optimize your investment portfolio to ensure it aligns with your financial goals and risk tolerance.

- Explore new opportunities for additional income streams, such as freelancing, consulting, or passive income ventures.

- Practice effective budgeting and financial management to make the most of your earnings and savings.

5. Are there any risks associated with having multiple income sources?

- While diversifying income sources can reduce risk, it’s essential to be aware of potential drawbacks, including:

- Overextension: Trying to manage too many income streams simultaneously can lead to burnout or decreased performance.

- Dependency: Relying heavily on a single source of income, even if diversified, can still pose risks if that source falters.

- Market volatility: Economic fluctuations or changes in industry trends can affect certain income streams, requiring adaptation and flexibility.

Conclusion: Secondary Source of Earnings

Diversifying income sources is a key strategy for achieving financial stability and independence. By exploring various avenues such as employment, business ventures, investments, rentals, and royalties, individuals can create a robust financial portfolio that mitigates risks and maximizes opportunities for growth. However, it’s crucial to approach income diversification thoughtfully, balancing the benefits of multiple streams with the potential challenges. With strategic planning, ongoing evaluation, and a commitment to financial management, individuals can effectively navigate the complexities of income generation and build a secure foundation for their future financial well-being. >>Secondary Source of Earnings